Triangular Arbitrage

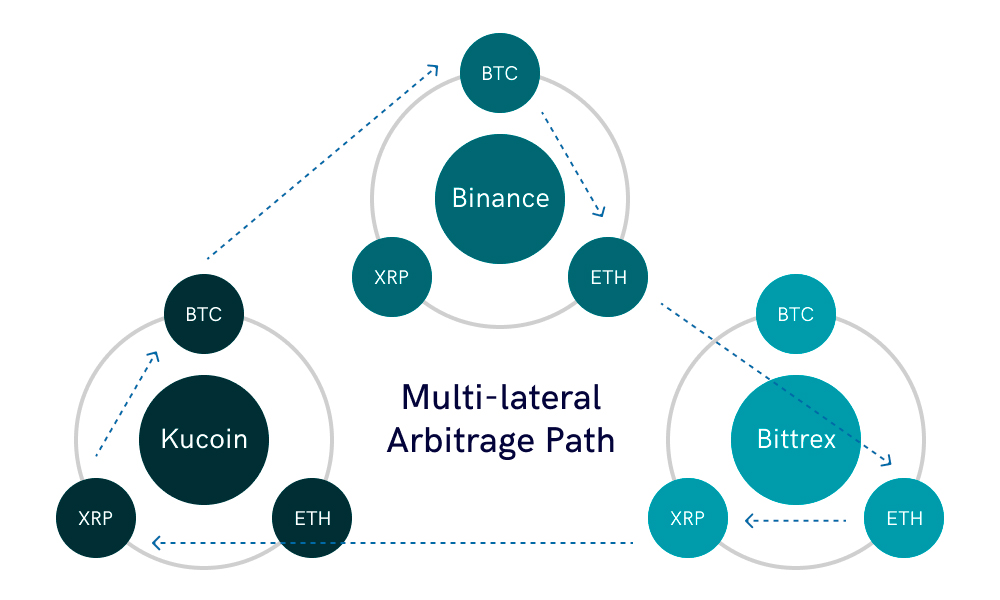

Triangular arbitrage is an event that can occur on a single exchange (or across multiple exchanges) where the price differences between three different cryptocurrencies lead to an arbitrage opportunity, since many exchanges have a number of markets with a variety of quote currency options. This opens up a long list of triangular trading patterns that can be leveraged to take advantage of inefficiencies in an individual exchange pricing.

Client Involvement – Automated

Investment Type – Staking

Sole Executor – Algorithm

Concept

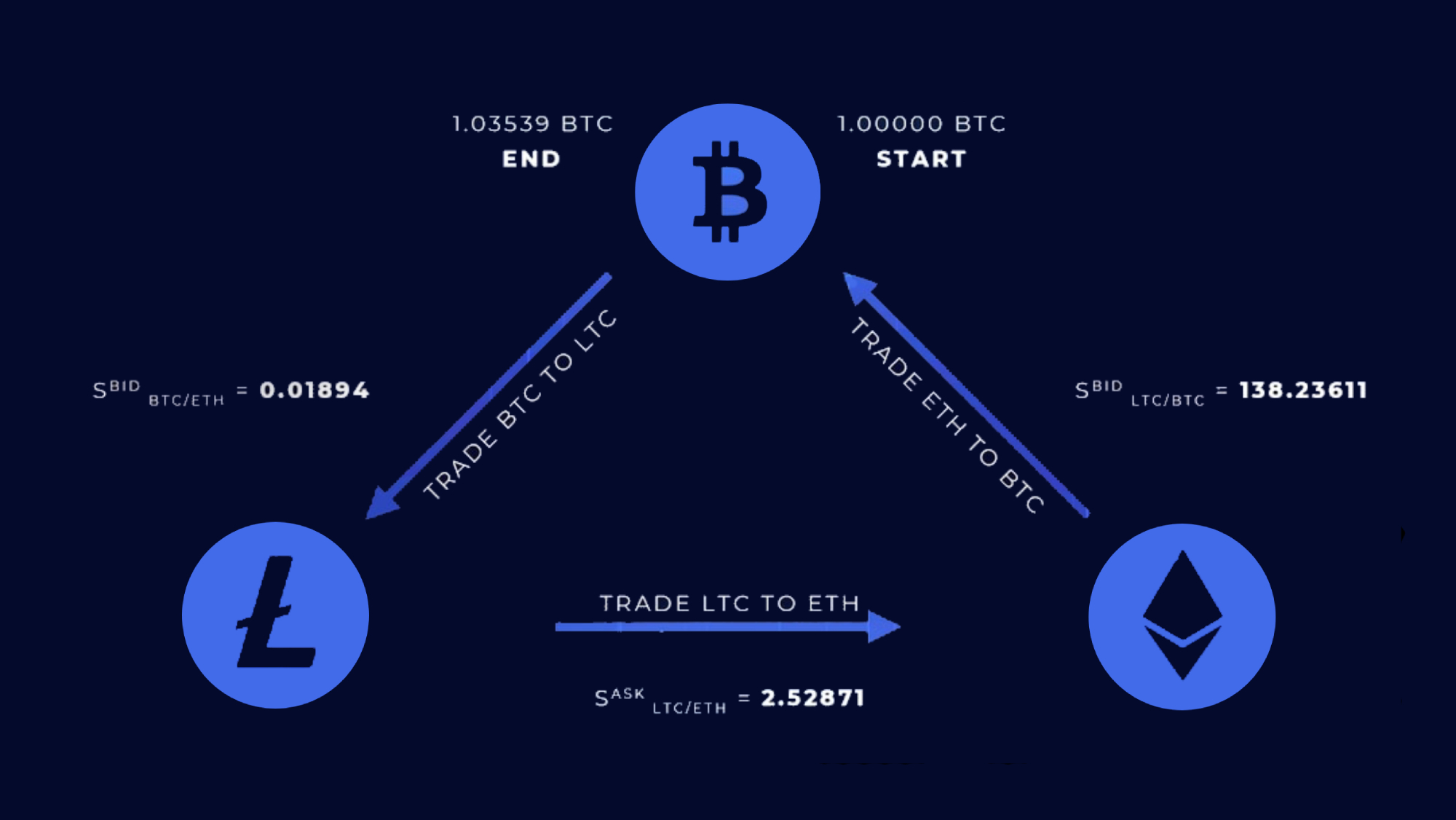

This illustration demonstrates how triangular arbitrage can lead to a return in profits.

In order to better illustrate how triangular arbitrage functions to generate profit, we have constructed an illustration to the right. As you can see in this example, we have 3 different asset pairs on a single exchange. On this exchange, we have an LTC/BTC, LTC/ETH, and ETH/BTC pair. The trading pattern to take advantage of an arbitrage opportunity is, therefore, the following:

1. Begin at one asset. This asset will be the asset to which we eventually return after completing the triangular arbitrage loop.

2. Trade to a second currency which connects to both the original asset and the next asset in the loop. This is required to prevent transversing on the same path.

3. Trade to a third currency which connects both the first and second asset. This second trade locks in a zero-risk profit due to the rate inconsistencies across the 3 pairs.

4. Convert the third currency back for the original asset.

In the illustrated example, we begin with a value of 1.0000 BTC. To calculate the value of the opportunity, go around the triangle and calculate the bid and ask prices for each trading pair. Note that the bottom trade uses the asking price and we divided ETH by LTC in order to calculate the ratio. Once each of these values has been calculated, we simply go around the triangle and multiply or divide based on the operation that is dictated in the illustration. This would look like the following:

1.00000 x 138.23611 ÷ 2.52871 x 0.01894 = 1.03539 BTC

Arriving back at BTC, we can compare the end value to our starting value to determine the size of the opportunity. As we can see in this example, the end value was 1.03539 BTC. If we compare this to the starting value of 1.00000 BTC, we find the value of this opportunity is 0.03539 BTC. This means that just by executing this arbitrage opportunity, we increase our BTC holdings.